Actuarial science formulas ~ B-kx-b Gausss forward formula. If cj 0 then cj is called an outflow. Indeed lately is being searched by users around us, perhaps one of you. Individuals now are accustomed to using the net in gadgets to view video and image data for inspiration, and according to the title of the article I will talk about about Actuarial Science Formulas Allotting the payments made on a loan between the borrowed principal amounts balance and also the interest due on a loan obligation under which a payment is done initially to the accrued interest is.

Source Image @ www.academia.edu

Pdf Formula Sheet For Actuarial Mathematics Exam Mlc Asm 2014 Monica Revadulla Academia Edu

In many countries actuaries must demonstrate their competence by passing a series of rigorous. The Society of Actuaries Research Institute offers many tables and tools including mortality tables calculators and modeling tools on risk topics. Your Actuarial science formulas images are available. Actuarial science formulas are a topic that is being hunted for and liked by netizens today. You can Download or bookmark the Actuarial science formulas files here

Actuarial science formulas - Varying force of interest t dAdt At. A temporary annuity certain is one payable for a limited term. Learn how to calculate Actuarial Method Loan - Definition Formula and Example. A cash-flow is a vector tj cj1jm of times tjR and amount.

An annuity due has payments that start the same year or time that the annuity begins at year 0. Actuarial notation extends to annuities certain as follows. February has 2829 days Exact o actualactual Uses exact days o 365 days in a nonleap year o 366 days in a leap year divisible by 4 Ordinary. B br Lagranges interpolation formula.

How much mathematics do they have to understand. A random cash-flow is a random vector Tj Cj1jM of times T. Actuarial exams arent the only thing that employers look at when theyre considering hiring a new entry-level actuary. Sum of geometric series S n a1 rn1 r Compound.

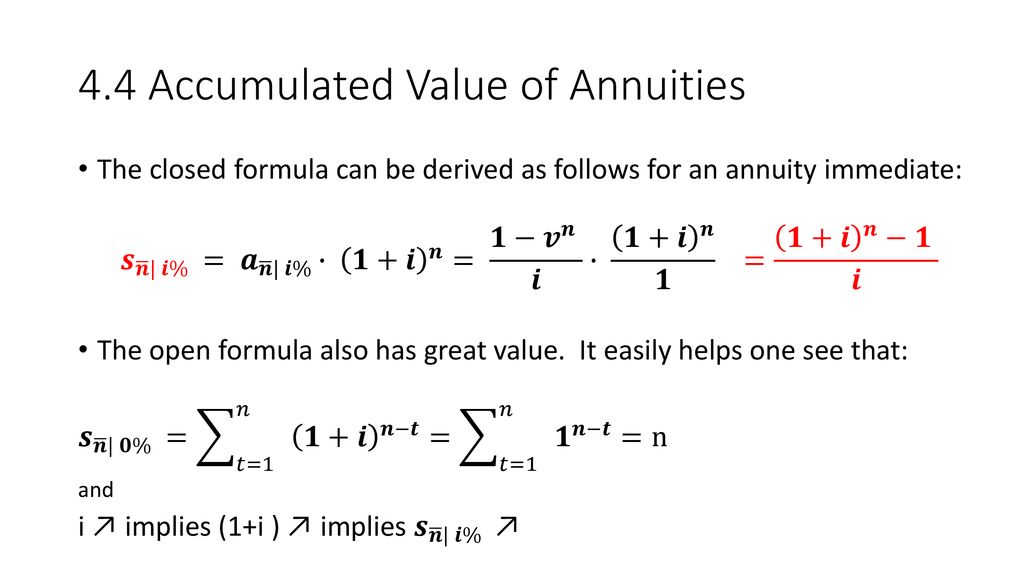

Being able to use pivot tables graphing features named ranges sorting capabilities. Quoted rate of interest and equivalent nominal rate of interest in. In actuarial science there are formulas for annuities immediate and annuities due. Having the right tools within reach helps you complete your everyday actuarial tasks with ease.

What is Actuarial Science. Annuity Immediate Visualization by Mackenzie Mitchell. 2 Fundamental Concepts of Actuarial Science to be used interchangeably of actuarial science. Learn vocabulary terms and more with flashcards games and other study tools.

As a result technology plays an important part in the field. Your marketability will be enhanced if you have above-average abilities with. More generally actuaries apply rigorous mathematics to model matters of uncertainty. Need for life actuaries to become more familiar with credibility methods.

Actuary science necessitates a great deal of formula computation and youll need the help of strong tools to fulfill your job. Positive amounts cj 0 are called inflows. Actuarial science is the study of how mathematical and statistical data can be used to analyse risks in finance insurance and other related industries. Newtons divided-difference formula.

In actuarial science there are formulas for annuities immediate and annuities due. What Models do they need to know. At A01 it A01 d t Simple. This paper provides an overview of the most common credibility methods and a review of.

Start studying Actuarial Science Formulas. An annuity immediate has payments that start on year 1 or one interest period after the annuity started. Varying installments and varying interest rates 5. Actuarial notation is a shorthand method to allow actuaries to record mathematical formulas that deal with interest rates and.

A sharp distinc- tion between foundations and standards is drawn intentionally. Its accumulation at the end of n years is denoted s n and its present value at the outset is denoted a nWehave s n n1 r0 1 ir. Calculating the Actuarial Reserve of a Policy. An annuity immediate has payments that start on year 1 or one interest period after the annuity started.

U UO xAuxAu- 1 x 13A3u- 1 x l Gausss backward formula. Separate and integrate At. At A01 it v 1 1i discount d 1 v. Constant force of interest ln1 i.

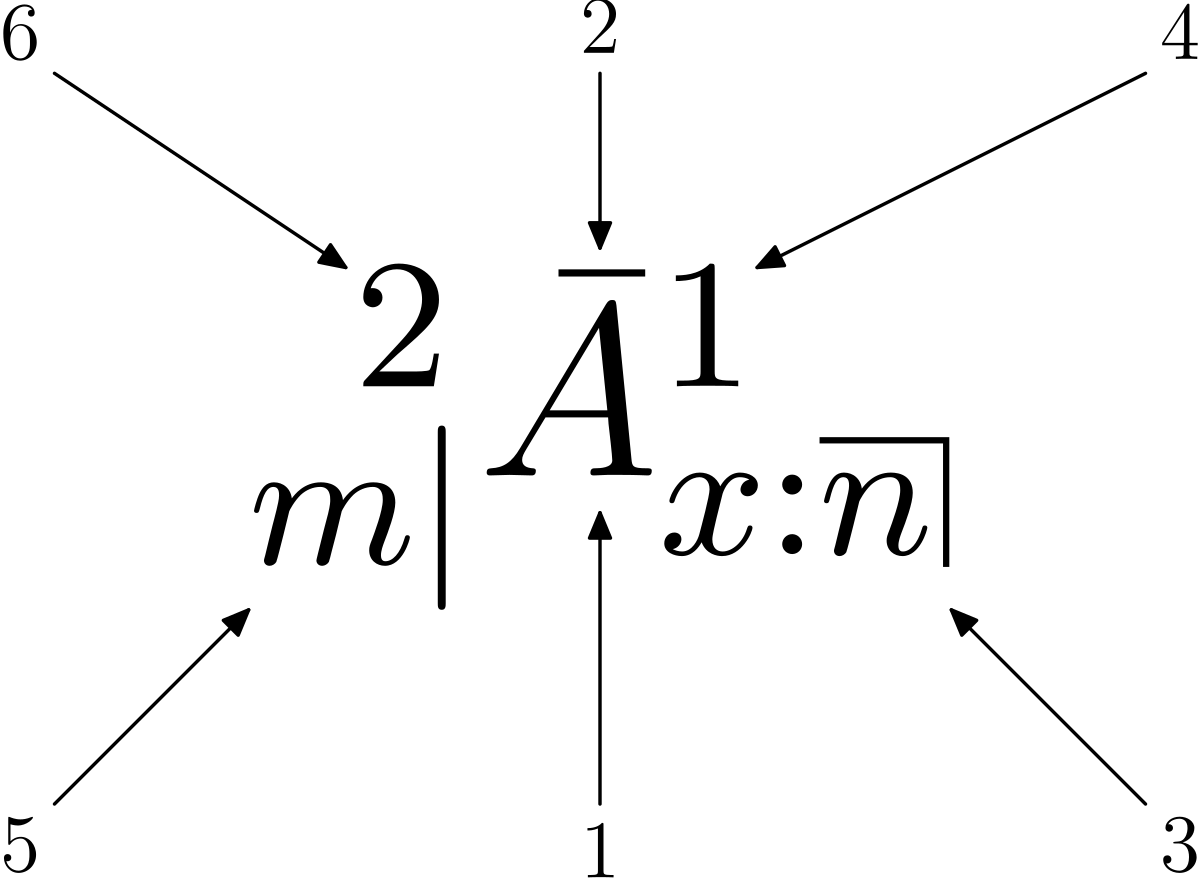

U ux-cI AuX-IX-b A. Write expression for L µ 𝑃 𝑇𝑥 𝑐 𝑃 𝑓𝑖𝑛𝑑 𝑐 𝑚 𝑖𝑑 𝑖𝑖 𝑚 𝐴𝑥𝑡 2. Actuarial Tables Calculators Modeling Tools. The formula for ane can be derived as follows ane 1v vn1 1vn 1v 1vn d.

Annuity Immediate Visualization by Mackenzie Mitchell. Such an approach can allow undergraduates with solid preparation in calculus not necessarily mathematics or statistics ma-jorstoexploretheirpossibleinterestsinbusinessandactuarialscience. Topics covered include health care pension plans.

The actuarial reserve is simply a sum of all the amounts that we need to invest today in order to meet our obligations under the policy. Treasury regulations have detailed a credibility method to be applied to pension plan mortality assumptions raising the importance of credibility for pension actuaries. Prospective method and retrospective method 2. The students are taught to apply various mathematical calculations and formulas to understand various financial models and their working.

Actuarial science is the discipline that applies mathematical and statistical methods to assess risk in insurance finance and other industries and professions. Interest Formulas o Force of Interest o The Method of Equated Time The Rule of 72 The time it takes an investment of 1 to double is given by Date Conventions Recall knuckle memory device. In this video I page through the Actuarial Bo. Actuaries are professionals trained in this discipline.

The intellectual content that underlies all of actuarial science is in the former while standards emphasize practice rather. So in the example above this 235849 133499 83961 453309 is our actuarial reserve. X-k- U 1 ub 1. V k x 1 e δ k x 1 displaystyle v k_ x1e delta k_ x1 implying double force of interest.

The simplest example is a level annuity of 1per year payable at the end of each of the next n years. E Z 2 E v k x 1 2 displaystyle E Z 2E v k_ x1 2 but often. For Actuaries Chapter 5 LoansandCostsofBorrowing 1. What do Actuaries really do.

Excel skills are important tooIf you want to be successful on the job you will need to know how to use Excel functions such as if-then statements vlookups summations and averages.

Source Image @ fr.scribd.com

Source Image @ en.wikipedia.org

Source Image @ www.youtube.com

Source Image @ en.wikipedia.org

Source Image @ www.pinterest.com

Source Image @ www.pinterest.com

Source Image @ slideplayer.com

Source Image @ en.wikipedia.org

Source Image @ www.academia.edu

If you are searching for Actuarial Science Formulas you've arrived at the right location. We have 10 graphics about actuarial science formulas adding images, pictures, photos, wallpapers, and much more. In these page, we additionally provide variety of images available. Such as png, jpg, animated gifs, pic art, logo, black and white, translucent, etc.

If the publishing of this web site is beneficial to your suport by posting article posts of this site to social media marketing accounts that you have got such as Facebook, Instagram among others or can also bookmark this blog page while using title Pdf List Of Formulas For Actuarial Mathematics Courses Monica Revadulla Academia Edu Employ Ctrl + D for computer system devices with House windows operating system or Command + D for computer system devices with operating-system from Apple. If you use a smartphone, you can even utilize the drawer menu with the browser you use. Whether its a Windows, Macintosh personal computer, iOs or Google android operating-system, you'll be able to download images utilizing the download button.

0 comments:

Post a Comment